Warning! Shipping company issued a notice of price increase in August!

Recently, some shipping companies have begun to announce a new round of freight rate adjustment plans for August. Maersk, Hapag-Lloyd and other shipping companies continue to adjust the rates of some routes, levy peak season surcharges PSS, etc.

Recently, some shipping companies have begun to announce a new round of freight rate adjustment plans for August. Maersk, Hapag-Lloyd and other shipping companies continue to adjust the rates of some routes, levy peak season surcharges PSS, etc.

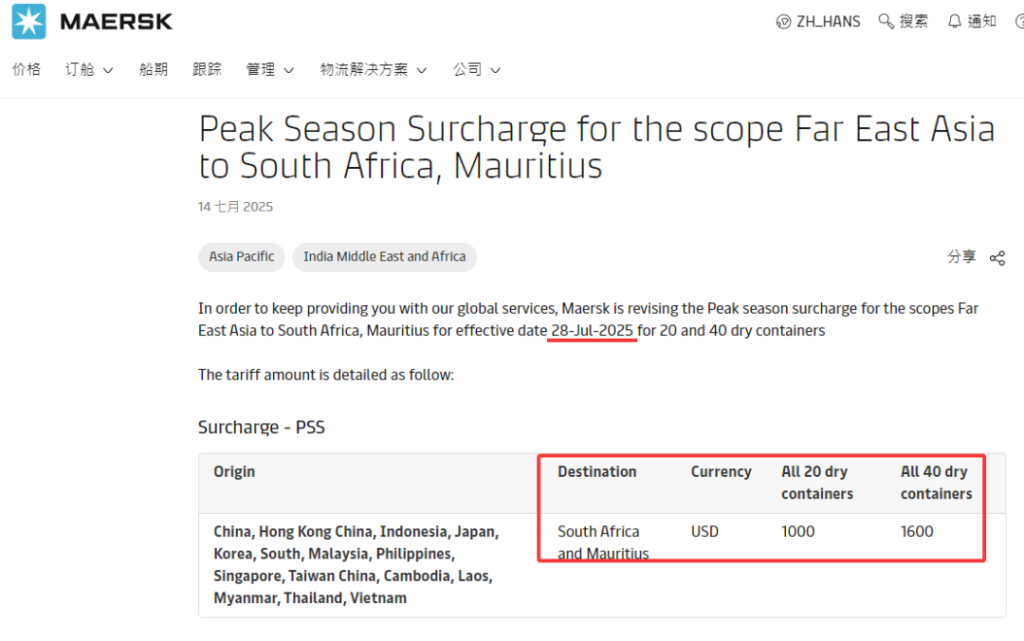

Maersk will adjust the peak season surcharge PSS for all 20-foot and 40-foot dry cargo containers on routes from China, Hong Kong, China, etc. to South Africa/Mauritius on July 28, 2025. The surcharge standard is US$1,000 for a 20-foot container and US$1,600 for a 40-foot container. Details are as follows:

Maersk will adjust the peak season surcharge PSS for all 20-foot and 40-foot dry cargo containers on routes from China, Hong Kong, China, etc. to South Africa/Mauritius on July 28, 2025. The surcharge standard is US$1,000 for a 20-foot container and US$1,600 for a 40-foot container. Details are as follows:

The freight rates on the European route have peaked temporarily, and the European economic recovery is relatively stable, but it is also affected by the unclear results of tariffs. The freight rates on the European route remained basically stable, with a drop of 0.09%, while the Mediterranean route fell by 7.04% due to factors such as increased capacity investment. The estimated data of the National Retail Federation (NRF) sounded the alarm for the market trend. It is expected that the import volume of major container ports will rebound in July, reaching about 2.36 million TEUs, a monthly increase of 14.56% and an annual increase of 2.1%, reaching the highest point since the beginning of this year. However, after the tariffs came into effect on August 1, the situation took a sharp turn for the worse. The import volume in that month will decrease by 11.86% month-on-month and 10.4% year-on-year, and will decrease month by month thereafter, with a year-on-year decrease of 19.9% in September, 19.2% in October, and 21.3% in November. This clearly shows that the peak season in the third quarter may soon pass, and the cold winter of the container shipping market seems to have arrived ahead of schedule.

Xie Zhijian, former chairman of Yang Ming Marine Transport, and other shipping professionals pointed out that the peak season in the third quarter is not prosperous at present, and the off-season may come early, and the off-season in the fourth quarter may be even weaker. The reasons are that, first, American retailers have been preparing goods in advance since the fourth quarter of last year, resulting in more than 1,700 bonded warehouses in the United States being full and a serious backlog of goods; second, the US tariffs on various countries are generally higher than before, especially the tariffs on major Asian exporters are about 20%-48%. The high tariffs make it difficult for Asia to resume normal shipments in the short term. Shipping companies such as Yang Ming and Wan Hai said that they will continue to closely observe changes in the demand side, the increase in the actual tariff rate of the final tariff agreement, and the impact on import prices and the economy. The decline in cargo volume on the trans-Pacific route has directly lowered freight rates. Industry insiders revealed that the spot market freight rate in the West Coast of the United States is about US$1,700-1,900 per 40-foot container, which is close to the cost line of alliance ships, and non-alliance small ships below 3,000TEU have even begun to lose money; the freight rate per 40-foot container in the East Coast of the United States is about US$3,200-3,400. Freight rates on the US West Coast route have risen and fallen rapidly, forcing shipping companies to re-implement measures to reduce and merge flights. In response to this situation, Mediterranean Shipping Company (MSC) notified customers last week to suspend Pearl route services and adjust the Asia-US West Coast route. Industry insiders believe that this move has two intentions. One is to hope that other alliance shipping companies will follow up and jointly reduce capacity to stabilize freight rates; the other is to prepare for the increase in freight rates in mid-July, which will be known as early as the 15th. On the evening of the 15th, China United Shipping confirmed that the company has decided to postpone the plan to reopen the US West Coast route. Industry insiders bluntly stated that at present, shipping giants such as MSC and Maersk have not yet expressed their views, and the volume of cargo has not improved, so it is difficult to raise prices in mid-July. In view of the current news, the United States will impose a 30% tariff on goods imported from the European Union from August 1, coupled with the congestion of European ports, etc., which may promote a rebound in European freight rates in the later period. Freight rates on Asia-Europe routes are expected to rise again in the next few weeks.